In the ever-evolving world of commodities, platinum group metals (PGMs) stand out as a category with unique significance. Comprising six closely related metals – platinum, palladium, rhodium, ruthenium, iridium, and osmium – PGMs play a crucial role in various industries, from automotive catalytic converters to electronics. As we navigate the complexities of today’s market, let’s take a closer look at the current trends influencing the prices of these precious metals.

The Automotive Catalyst Connection:

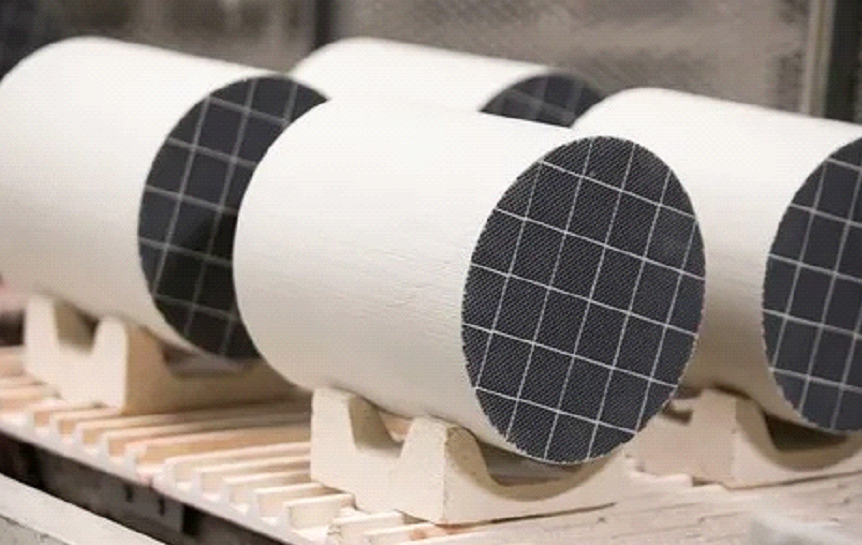

One of the primary drivers of the PGM market is the automotive industry, particularly the demand for catalytic converters. Platinum, palladium, and rhodium are essential components in catalytic converters, serving to reduce harmful emissions from vehicles. With global initiatives to combat climate change gaining momentum, the demand for cleaner, greener automotive technologies has surged, directly impacting PGM prices. As automotive manufacturers strive to meet stricter emission standards, the market for PGMs remains dynamic.

Palladium’s Price Surge:

Palladium, a key player in the PGM lineup, has experienced remarkable price volatility in recent years. The surge in demand for palladium, driven primarily by stricter emission regulations and the increasing popularity of gasoline-powered vehicles, has led to a supply-demand imbalance. As a result, palladium prices have reached record highs, creating both opportunities and challenges for market participants. Investors and industry observers closely monitor these fluctuations as they navigate the palladium market landscape.

Rhodium’s Astonishing Rally:

While palladium has been making headlines, rhodium, another crucial PGM, has quietly experienced an astonishing rally in recent times. Rhodium is indispensable in catalytic converters for diesel engines, and its unique properties make it extremely effective in reducing nitrogen oxide emissions. The limited global supply of rhodium, coupled with rising demand, has propelled its prices to unprecedented levels. Understanding the factors behind rhodium’s surge provides valuable insights for stakeholders in the PGM market.

Global Economic Factors:

Beyond the automotive sector, broader economic factors also influence PGM prices. The interconnectedness of global markets means that geopolitical events, economic policies, and trade dynamics can impact the supply and demand for PGMs. As the world economy continues to recover from various challenges, keeping a close eye on these macroeconomic factors becomes crucial for anticipating shifts in PGM prices.

The Role of Recycling:

Given the strategic importance of PGMs, recycling plays a vital role in the overall supply chain. With specialized companies focusing on the recovery of PGMs from spent catalytic converters and electronic scraps, the recycling sector contributes to sustainability efforts while influencing market dynamics. Examining the recycling landscape provides insights into the circular economy’s impact on PGM availability and pricing.

Conclusion:

Navigating the platinum group metals market requires a comprehensive understanding of the intricate factors shaping its dynamics. From the automotive industry’s pursuit of cleaner technologies to the astonishing rallies of individual metals like palladium and rhodium, staying informed is key for investors, industry professionals, and enthusiasts alike. As we continue to witness the evolution of the PGM market, one thing remains clear – the interplay of innovation, regulation, and global dynamics will continue to shape the future of these precious metals.